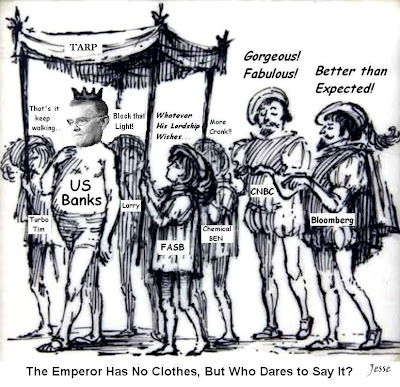

Wirklich ein fantastischer Weg um das immer noch nicht vorhandene Vertrauen zurückzugewinnen..... Nach der Neuigkeit das immerhin beachtliche 68% der Institute den Strest Test bestanden haben ( unter realen Bedingugen läge die Quote wohl unter 10% ) und unter der realistischen Annahme das sich kein privater Invetor finden wird der in die durchgefallen Institute investieren würde haben sich Geithner und Bernanke einen neuen Taschenpielertrick ausgedacht. Man nehme einfach die mit Tarpmitteln erworbenen Vorzugsaktien und tausche diese in normale Aktien um..... Schon ist der Kapitalbedarf gedeckt...... Hört sich unlogisch an und erinnert eher an Enron & Co ......... Herzlichen Glückwunsch: Der gesunde Menschenverstand ist bei Euch noch nicht abhanden gekommen....

April 29 (Bloomberg ) —

At least six of the 19 largest U.S. banks require additional capital, according to preliminary results of government stress tests, people briefed on the matter said.

While some of the lenders may need extra cash injections from the government, most of the capital is likely to come from converting preferred shares to common equity, the people said.The Federal Reserve is now hearing appeals from banks, including Citigroup Inc. and Bank of America Corp., that regulators have determined need more of a cushion against losses, they added.

By pushing conversions, rather than federal assistance, the government would allow banks to shore themselves up without the political taint that has soured both Wall Street and Congress on the bailouts. The risk is that, along with diluting existing shareholders, the government action won’t seem strong enough.

Now on to the common sense view.....

Nachfolgend ein paar Meinungen die aus der Abteilung "gesunder Menschenverstand" kommen.....

Option Armageddon

As for converting preferred to common, yeah that will boost TCE, but it doesn’t actually ADD any capital to banks’ balance sheets. 67¢ cents of preferred equity + 33¢ of common equity = $1 of total shareholder equity. Convert all the preferred to common and you still have only a $1 of total equity. There’s no extra capital on the balance sheet to absorb losses.

Barry Ritholtz

And, now that some of the results are coming in, the cure for inadequate capital is not more capital, but an accounting trick — converting preferred stock to common

US banks are suffering a solvency problem, and what they need is more capital, not an accounting sleight of hand. Yet that is precisely what they are getting — the same clever financial engineering that led to the crisis in the first place.

Paul Kasriel including some simple example that even Geithner & Bernanke should understand...... :-)

Treasury will just convert $5 of the preferred shares it owns in Gotham to $5 of common equity. This is shown in Balance Sheet Two. Now Gotham is well capitalized, right? Wrong. The depositors and the bond holders always were in line in front of the preferred shareholders in case Gotham had to be liquidated. So, moving $5 from the preferred equity category to the common equity category does not make the depositors and bond holders any better off.

In sum, Treasury's plan to enhance the capitalization of some financial institutions by beating preferred equity shares into common equity shares is accounting alchemy.

I´ll finish with a rant on "Paulson, Timothy “turbo tax override deductions” Geithner & “Helicopter” Ben Bernanke" from Pigpen via The Barricade :-)

Denke der gelungene Abschluß für dieses Posting ist ein "netter" Kommentar über "Paulson, Timothy “turbo tax override deductions” Geithner & “Helicopter” Ben Bernanke" von Pigpen via The Barricade :-)

Thanks to

Thanks to

All this with a commercial loan & lease book well over $ 200 billion.......

All this with a commercial loan & lease book well over $ 200 billion.......

The trend is definitly not GE´s friend.......

The trend is definitly not GE´s friend....... "Imagination at work"......... During the past year GE´s inftastructure segment ( along with Buffet ) was able to bail their financial arm out..... Lets hope their new equipment orders will at least stabilize ( now down 21 % yoy from high level & with hope of a rebound thanks to the numerous stimulus programms worldwide)... Nevertheless nice to hear that GE & the rating agencies predict no need for more capital...... UPDATE:

"Imagination at work"......... During the past year GE´s inftastructure segment ( along with Buffet ) was able to bail their financial arm out..... Lets hope their new equipment orders will at least stabilize ( now down 21 % yoy from high level & with hope of a rebound thanks to the numerous stimulus programms worldwide)... Nevertheless nice to hear that GE & the rating agencies predict no need for more capital...... UPDATE: