Kein Wunder das Gold sich trotz zwischenzeitiger $ Stärke weiter gen Norden stürmt..... Ich empfehle zudem noch ECB A Dumping Ground for Financial Toxic Waste von Lee Adler zu lesen sowie zwingend den Clip anzusehen. Sieht so aus als wenn diese Hypotheken zum Teil jetzt bei der EZB lagern......

Spanish banks' reliance on ECB funding surges FT

The European Central Bank has in effect funded new lending in Spain in recent months, replacing banks' use of wholesale capital markets, which have been strangled by the global credit crunch.

Spanish banks doubled their share of the ECB's weekly funding auctions in the final quarter of last year, taking their borrowing up to €44bn ($64bn) in December from a running average of about €20bn over the previous 15 months, according to the most recent data from the Bank of Spain.

This extra lending of almost €24bn outstrips the quarterly amounts raised previously by Spanish banks from securitisation markets, which is an important comparison because the banks have increasingly used mainly mortgage-backed securities as collateral with the ECB.

The market for securitised debt and for mortgage-backed bonds in particular has been almost entirely shut since the credit crunch hit last summer and investors began shunning all kinds of complex, structured debt.

The Spanish banking system is second only to the UK in Europe in its use of mortgage-backed bond markets and other securitisations to fund lending.

However, the Bank of England did not accept mortgage-backed debt as collateral in similar lending operations until after the run on Northern Rock.

However, the Bank of England did not accept mortgage-backed debt as collateral in similar lending operations until after the run on Northern Rock.

Jean-Claude Trichet, president of the ECB, last week insisted the central bank had not been bailing out banks in Spain, but said that there had been a marked increase use of securitised bonds as collateral by Spanish banks and others.

Bank of England lending to UK banks grew by about £6.2bn over the same period, but there is no data on the collateral used. In the US, the Federal Home Loan Bank has pumped $750bn into the system by extending longer-term funding direct to mortgage lenders, such as Countrywide.

The big difference is that European banks must re-raise this funding every week and the mortgage- backed bonds pledged at the ECB eventually will have to find their way to the capital markets, which many analysts believe could mean that markets such as Spain are potentially storing up problems for the future.

While markets for securitised debt remain closed, it is difficult to put a price on European mortgage-backed securities and banks in the region can be much slower to mark down the value of holdings of such bonds. By accepting them in exchange for cash, the ECB may be delaying the repricing of risk that analysts believe is necessary for the orderly resumption markets in such debt.

"The credit markets have been on heroine and while the US solution is put them through cold turkey, the Europeans want to put them on methadone," said one London-based economist.

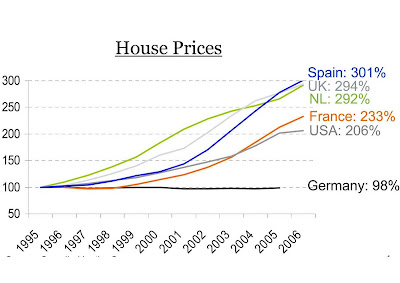

> Toro has some more thoughts & data on spain

> Toro hat noch weitere Gedanken und Detail zum Thema Spanien

No comments:

Post a Comment